5 Equine Business Mistakes to Avoid

Do you have an equine business? Stacey Yalenti of Abby Road Group shares a few common pitfalls.

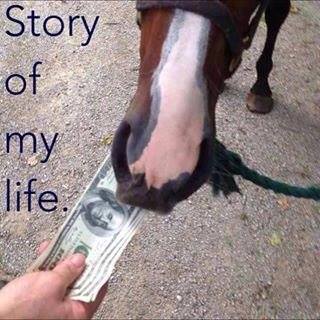

Not having a business budget and evaluating the business financials.

Most horse people are not rich. And while it is obvious that multi-million dollar companies need a strong CPA, it is also important for the $20,000, $50,000 and $300,000 companies to have a strong CPA to turn to for accounting, bookkeeping services and tax services.

A lot of people are scared of making or talking about a budget, but you shouldn’t think that way. Budgets are essentially goals written in numeric format. How many horses do I need to train, how many lessons do I need to give, how many horses do I need to board to support expenses A, B, C, D, E & F. Revenues are much easier to control than expenses. Sadly, accountants are not gifted with magical abilities and a budget won’t get you everything you want overnight, but in time you will be pleased with the results.

Then the next step is to evaluate your actual results to your budget at least quarterly so you can make changes if things are unraveling.

Overdrafting the business bank account

The bank loves when you overdraw your account, and often unbeknownst to you enrolls you in “overdraft protection.” So rather than declining your card, the bank is covering your overdraft until you make a deposit, and they cover your next charge that day, and the next, and the next, all at $35 a pop!

Let’s put that in perspective: Your account is overdrawn, and you go to the tack store and buy polo wraps for $15. Your debit card goes through, but your bank “loans” you the money for a $35 fee. You just paid interest of 333% on those wraps!!

Just say no to making payments on polo wraps.

Flickr: Five Furlongs/ CC

And this goes on until you make a deposit into your account. If you own a business, I urge you to open your bank statements and make sure you are not overdrawing your account. If you are, install a bank app on your phone and check it before EVERY. SINGLE. PURCHASE. Nobody will ever get ahead if they continually pay interest upwards of 100%. That is crazy. People are complaining that mortgage rates are over 4%. We don’t want to pay 4% for the roof over our head, but we’ll pay 333% interest on a hoof pick and some fly spray?

If being cash poor is a never-ending issue for you, then you are better off borrowing the money from Vito or Vinnie or some other loan shark, because their money is actually cheaper.

Being the clearinghouse in a horse sale

Many states subject horse sales to sales tax. One exemption for having to charge and remit sales tax is if a CASUAL SELLER (someone whose occupation is not in the horse business) sells a horse. For example, if I were to sell my mare, Abby, I would not be responsible for charging NJ sales tax on the sale because my occupation is as an accountant and my place of business is not a horse barn.

If you are in the horse business and you broker sales for clients, consider yourself similar to a realtor in the transaction. The only money that should flow into your bank account is the commission check after the sale closes. Commissions should be made clear to the client and be a part of the written contract.

A risk that I often see is clients using their business bank accounts as the clearinghouse for the sale. Significant sums of money flow in and out of the account, and in the end the commission is left. If you do this and get tagged in a state sales tax audit, the state could EASILY nail you for not collecting and remitting sales tax on the horse sale. That leads to you then having to pay the sales tax out of your own pocket plus interest and penalties for breaking the law. Horse businesses have to collect sales tax (in many states), and for all intents and purposes the amount deposited into your bank account sure looks like you sold the horse. If your client handles the money end of their own transaction, everyone is safe because they are likely a casual seller, and in the end you still get the same amount of commission but none of the risk.

Not filing 1099’s at the end of the year

1099s are due to be filed by January 31st each year. I’ve heard all sorts of nonsense and excuses from people, and before I get all GEORGE MORRIS AT A JUMPING CLINIC I figured I’d dial it down and go over the 1099 process.

1099s are considered information returns that must be filed by businesses. They must be issued by a business to any unincorporated person or business who provides more than $600 in services or rent during the year. Common ones are barn rent, farrier, vet, chiropractor, bodyworker, trainer, barn help, repair man, braiders, clippers, lawyers, accountants etc.

Suppliers, such as the hay guy, feed store and shavings guy do not need to be issued a 1099, as they provide supplies and not services. Same goes for the tack shop. No 1099s to suppliers.

In order to file a 1099, you must know the total you paid the vendor and have their real name, address and SS# or Tax ID. The easiest way to obtain this information is to ask the vendor to fill out a W9 form.

The purpose of a 1099 is to make sure vendors are claiming their income and not hiding it. A few years ago the IRS added two new questions to the tax return: Do you have vendors who qualify to be 1099’d? and If yes, did you issue 1099s? If you lie on those questions, you have committed fraud by lying on a tax return, and fraud can cost you everything you have and worse.

The IRS receives a copy of all 1099s you file, and their computer systems do a check to make sure your vendors claim that income when they file their taxes.

Here’s an adorable baby foal to keep your brain from exploding.

Giphy

If you are caught not filing a 1099 for someone, you will have the fine of $250 per non-filed 1099, and the IRS could take away your expense deduction. For example, if you paid your vet $15,000 during the year, and you are caught not filing a 1099 for them, you will be fined $250, and the IRS can increase your income by $15,000 (ie, take away that deduction), which will cost you $2250 in taxes if you are in the 15% tax bracket.

If one of your vendors refuses to fill out a W9 form, you should strongly consider replacing them as a vendor. They are pretty much saying they are not claiming the income and putting the risk on you. If you have one of these people you should still file a 1099 on them and in the SS# box put “refused to provide.” They may be audited, but you covered your butt.

If you have never issued 1099s before, that certainly does not mean you do not have to this year or going forward. Unless you are retiring this year and closing your business, you need to get on the wagon and run your business properly. That means complying with tax laws.

If you want to be ahead of the game for 2015, have any new vendors fill out a W9 form before you give them their first payment. This way, next year’s 1099 time will be less of a headache.

Posting sloppy content online

If you run your own business and are under the age of dead, it is important to know that social media is not going to go away. Facebook, Yelp, Instagram, etc. catapult businesses into worlds that would never have been reached 20 years ago.

When your brand is representing you on Facebook, or in an ad in a prize book, it is imperative your content looks as polished as your horses in the show ring. Our new favorite website is www.picmonkey.com which allows the lay-person to create perfectly edited photos, flyers, invitations, ads etc. PS: It’s FREE!!

Running your own business allows you to earn a living doing something that you are passionate about. In today’s business environment, potential clients often pass judgment on you BEFORE they ever talk to you. Google is everyone’s best friend, and cyber scoping is the norm. If your Facebook posts, tweets, blogs, newsletters, website, business cards, etc. look unfinished, or worse, sloppy, a potential client will assume that your actual work in trade is equally as careless.

Stacey Yalenti, CPA is the owner of Abby Road Group, which provides accounting, bookkeeping and tax services to equine businesses using cloud based technology, servicing clients throughout the US.

Leave a Comment